GST kya he.

GST (goods & Service Tax) Tax ka ek prakar he. Jo Tax me Indirect tax he. Is Tax ko Bharat (India) me 1 July 2017 se sabhi Goods or Service me lagu kiya gaya he. Agar aap ek Business man he or aapki Earning Tax me dayre me arahi he to apko 1 july 2017 se ek Tax GST dena hoga. yani 1 July se Indirect taxes (Vat, CST, Excise Duty, other taxt) Convert hokar ek GST me samayojit ho gaye he. dosto Ager aap new User ho or apo tax me bare me bilkul bhi jankari nahi he to ek bar hum pahle Tax ko samjhate he.

Tax kya he.

Tax:-राष्ट्र निर्माण में कंपनियों व देश के नागरिको द्वारा दिया जाने वाला अनिवार्य योगदान है |Tax do prakar hote he.

1-Direct Tax:-ve tax jo logo ki income se liya jata he.is tax ko logo, companyon me shidhe sarkar dwara lagaya jata he.

jaise :-Income tax, corporate tax, capital tax,

2-Indirect Tax:-direct Tax ke alava jo tax goverment drawa logo se shidhe washul nahi kiya jata ye tax any madham se goods & Services dwara liya jata he.

Jaise:-excise tax, vat, sale tax, stump duty, service tax, entertainment tax.

Vat:- ye tax state govt dwara state ke ander goods ko sale purchase me lagaya jata he.

Sale tax:- ye tax central govt dwara ek state se dusre state me goods ko purchase or sale ke lagaya jata he.

service tax:- ye tax jo bhi seva upbhogta ko di jatie he usme ye tax hotels Restrorent or online transaction v any services me lagaya jata he.

GST ko samjane ke liye ek Vistar me VAT ko samjhate he.

VAT:- Value Add Tax (मूल्यवर्धित कर ) जब Dealer product को अपने राज्य में Sale करता है तो उसके Purchase मूल्य में अपना profit जोड़ते हुए मूल्य में वृद्धि करता है इस मूल्य वृद्धि में राज्य द्वारा कर लगाया जाता है जिसे हम Value Add Tax (मूल्यवर्धित कर )कहते है |

|

| Vat Example |

उदहारण :- purchase goods 100.00

Input vat@10% 10.00

total Purchase Price 110.00

Sold goods to Consumer 200.00

Output Vat@10% 20.00

Total Sale Price 200.00

Culculation Vat To piad State govt.

Paid Vat=Output Vat-Input Vat

= 20.00-10.00

=10.00

dosto ab GST me ate he.

1 july 2017 se bharat sarkar dwara sabhi tarah ke indirect tax ko 1 tax (GST) me samayojit karke GST lagu kiya gaya he. jiska matlab he One nation One Market tax =GST

GST pranali kis tarah se kam karegi.

koi bhi prodect jo hum purchase kar rahe he. wo Manufacturing Production se lakar sale karne tak, kai prakriyawo se se hote hue hum tak pahuchta he.ye steps kis prakar he

1-Row Material :-kachcha saman jisse vo product banega.

2-Production:- karkhane me saman banana.

3-warehouse:-bane hue saman ka godown jaha per saman me tag or Label laga kar Retailer ko Sale karte he

4-Retailer or whole saler:-saman ko dukandar seller ko Sale karte he.

5-Consumer:- Akhir me Seller jisko saman Sale karta he.

Is puri prakriya me Jo product ki muly me virdhi hui he usme State Govt dwara VAT lagaya jata he. and Production me Uss prodect me Excise Duty lagaya jata he. or fir warehouse se lakar Retailer tak is prodect me Vat lagaya jata he. lekin Ager hum Isse kisi or State me sale kar rahe he jo State ke bajay isme CST Central Govt. dwara jagaya jayega.

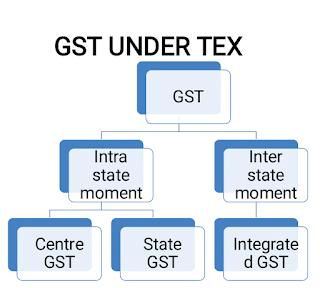

GST me 3 tarah ke Tax hote he jo ki Central govt or State govt. dwara washul kiya jata he. ye 2 Tax is prakar he.

1-SGST- State goods & services Tax ko State dwara liya jayega jab lenden State ke under hoga. Jiski dar GST ki Dar ki adhi 1/2 hogi.

2-CGST-Central Goods & services Tax ko Central dwara liya jayega jab lenden State ke under hoga.Jiski dar GST ki Dar ki adhi 1/2 hogi.

note:- SGST or CGST dono tax ko ek sath State ke under business karne pur goods & Service me jagaya jata he.

3-ICST- Integrated Goods & Services Tax ko Central drwa liya jayega jab lenden ek State se dusre state me hoga.Jiski dar GST ke Dar ki dar hogi.

Gst dohri tax kary pranali he yani ki ek samay me 2 tax lagenge to jante he kis kis transection me SGST, CGST or IGST lagenge.

1-Intra State Sale:- State ke Under Sale karne par SGST or CGST lagega. GST=CGST+SGST.

2-Inter State Sale:-ek State se dusre State me sale karne per IGST lagega. GST=IGST=CGST+ SGST.

GST ki दर

GST ki दर All India me 5%, 12%, 18%, 28% hogi.

Example ager ghee me GST 12% he. to India me har State me GST ki dar ghee me 12% hi hogi Chhahe Ghee karnatak State me banta he or Uttarakhand me Sale kiya jate he.

Intra State Sale:- karnatak me ghee Karnatak ke dealar ko sale karne perGhee price 500

SGST 6%=30

CGST 6%=30

total price= 560.00

Inter State Sale:-Karnatak se Uttarkhand ke Dealer ko sale karne par

Ghee price 500

IGST 12%=60

total price= 560.00

dosto abi tak humne GST ke bare me Basic lavel tak jana he. is puri prakyia ko ek or Example ke dwara jante he.

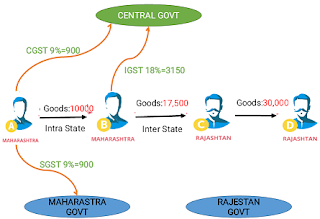

Example:-Mahrastra ke 'A' dealar ne 10,000 रु. me Mahrastra ke hi ek 'B' Dealer ko sale kiya. jisme GST ki दर 18% hai. Is GST me SGST 9% ki दर & CGSt ki दर 9% hai. SGST=900 OR CGST=900 TOTAL GST= 1800. 'B' Dealer ne Us saman ko Rajistan ke 'C' Dealer ko 17,500 रु. me sale ki. Is me GST ki दर 18% hai. Is IGST ki दर 18% hai. IGST=3150. 'C' Dealar dwara us saman ko Rajisthan ke 'D' Dealar ki sale kiya jata he 30,000.00 रु. me. Jisme GST ki दर 18% hai. Is GST me SGST 9% ki दर & CGST ki दर 9% hai. SGST=2700 OR CGST=2700 TOTAL GST=5400.

Thanks for sharing this blog. Great blog. GST

जवाब देंहटाएंthanks

हटाएंsir telly ka exam patern kha se milega

जवाब देंहटाएंHindi ya English

जवाब देंहटाएंthanks for gst information.

जवाब देंहटाएंthanks for expalan gst,sgst,cgst,intergrated gst information....

जवाब देंहटाएंthanks RK.

हटाएंnice \

जवाब देंहटाएंthanks

जवाब देंहटाएंNICE

जवाब देंहटाएं