tally ke latest version tally erp 9 release 6.4 or above ke version me apko e-way bill ki .json file create karne ka option milta jiske dwara apko invoice ki .json file create karke use GST e-way bill portal me upload karke asani se e-way bill generate kar sakte he. to jante he.

tally me e-way bill create karna.

dosto sabse pahle akpe pass tally ka latest version 6.4 or 6.4 se above ka download karke install ya apna tally ko 6.4 me update karna hoga iske bad hi apko tally me e-way bill se related option show ho payenge.tally me e-way bill option activate karna.

tally me e-way bill option ko activate karne ke liyestep 1:- Press f11 Feature.

step 2:-to go Statutory & Taxation or press S key

step 3:-Enable goods & Service tax(GST) =yes

then

step 4:-set/alter GST detaisl =Yes

then

step 5:- e-Way bill applicable =yes

e-Way bill applicable from :- ya date fill karni he 1 April se ya 1 Feb or 15 April (jo date ap fill karenge uss date se pahle ki entry karne per e-way bill generate nahi hoga.)

step 6:-e-way bill threshold :=50000 (yaha per e-way genrate ke liye minimum amount kya he. fill karni he.)

then Enter Ener or CTRL+A

dosto is process ke bad apke tally software me e-way bill option activate ho jayega.

- इन्हें भी जाने :-

- taE-way bill kya he

- tally online course kya he.

Sale voucher or Purchase Voucher me Invoice mode me Entry karni he. jaha per apko e-way bill ka option Show hoga.

e-way bill ki .json file tally me create karna.

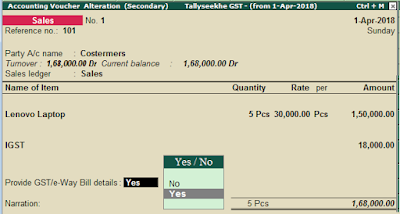

dosto ab hum ek entry karte he jiska hame e-way bill generate karna he.2.goods Sold Delhi 1,68,000.00 and invoice are-

Item name Quantity Rate per Amount

Lenovo laptop 5Pcs. 30,000.00 Pcs. 1,50,000.00

IGST 18,000.00

Total Amount 1,68,000.00

to go tally

Enter

Accounting Voucher

Go to Sales Voucher or Press F8

Party name:- Delhi Dealer

Fill karte Dispatch and Buyer’s Details (Ye bahut jaruri he e-way bill ke liye)

Dispatch details:

-------------------------------------------

Delivery note: end of list ( Agar aap Godown se goods deliver karte he. to delivery challan no. fill karna he other wise no.)

IF ASK DATE

date:-Godown se delivery Challan generate date fill karte he.)

dispatch doc no. :Transport dwara Create document no. (NO)

Dispatched through : Transporter Name

Destination :- Jis jagah goods diliver karne he us jagah ka naam (like delhi)

Bill of Lading /LR-RR No: 150

Date:-date fill

Motor Vehical No. DL1LR-1262 (gadi ka number fill kare)

Order detials:

--------------------------------------------

Order no:- agar hamne pahle order banaya he to us Order ka no. fill kare

Mode/Term of Payment:-Cash or Credit (due date )

Other Reference(s):- agar koi Reference he to aap type kar satke

Terms of Delivery:- Free or Slipped Charge se koi bhi Terms use kar sakte he.

Buyer Details:

Buyer:-Name of (Buyer) Person

Address:-

Country:-

State:-

Place of Supply:-

GSTIN/UIN:-

(Ledger ke asusar auto fill hoga /cash me hone per hame fill karna hota he.)

Sales ke liye Sale ka GST applicable Ledger select karte he.

Item Name:Lenovo Laptop

Quantity: 5pcs

Per Price: 30,000.00

then Select End of List kyo ki Is Item ke bad hamne koi or Item Purchase nahi kiya he.

then Lenovo Laptop 1pcs ka Sale ka Total Price hua 30,000.00

ab Tax ke Ledger select karte he

IGST=18,000.00

Net Price hua =1,68,000.00

Provide GST/e-way bill details :no/Yes Yes me enter kare

----------------------------------------------------

e-way bill details

e-way bill no: generate nahi hua he. is karan blank hota he.

Sub type*:Supply

date:date jis din e-way bill generate kiya he.

Document type: tax invoice

Transporter details

Mode*: Road/Train /Other

Transporter Name:-

Doc/Lading /RR/Air way no:-152

Transporter Id**:Buyer ka GSTIN or Other ID

distance (in KM)*: distance fill kare (company se Buyer )

Vehicle Number**: (Gadi ka no fill kare Is format me GST State code fir Gadi ka no.)

Consignee details:

Consignee:-Corrial name

Adress 1:

Address 2:

To Place:(Destination) (jaha deliver karna he us jagah ka name)

State*:delhi

Pin code:

GSTIN /UIN*:

then apkp Entry accept karni he.

then

Exporting details for e-way bill:- Yes or NO me click karke same details fill kare.

Format:-JSON e-way bill Details (Data Interchange)

Export Location:- file This PC or My comper me jis folder me save karni he uss chune.

Output File Name:file ka name type kare.

Open Exported Folder: Yes agar ap chahte he ki file export karte hi open ho jaye. like us (E:\\)

then

enter

enter

Export Yes or NO Y press kare.

apki e-way bill (this pc or my computer ke E: Drive open ho jaygi.

- इन्हें भी जाने :-

- how to Create Balance sheet in hindi.

- tally me Discount ki Entry kaise kare

step 1:- portal open kare

step 2:- e-way bill option me

Click to Generate Bulk

step 3:- apko e: drive se ya jaha apne tally ki file save ki he us folder se tally ki .json file upload karna hi

to aap folder se file upload kare

then

step 4:- click upload

note:-Ager koi error ata he to uss error ko dekhe or tally se us error ko sahi karke dobare e-way bill ki .json file ko upload kare.

step 5:- then click Generate

apka e-way bill no Generate ho jayega.

us e-way bill no ko Copy kare. jiske dwara aap e-way fill ka print out nikal sakte he.

then

e-way bill no. se e-way bill print karna.

step 6:- click to home.

step 7:- e-way bill option me

step 8:- then click

EWB Print

enter

EWB NO:- yaha e-way bill no fill ya paste kare.

step 9:- then click Go

apka eway bill print ke liye ready ho jayega.

ap apko detail dekhane or print ke liye

step10:- Details prints me click kare.

then click to print apka e-way bill ka print out printer se nikal jayega.

ap apko tally me e-way bill no invoice me fill karna he iske liye ap tally me jaye. or e-way bill wali

invoice ke Update e-way bill Information me

Note:-Agar entry complete ho chuki he or option show nahi ho raha he to aap

Display/StatutOry Report/GST/e-Way Bill/Update e-way bill Information /

me jaye or

Buyer ka Ledger select kare.

date:-from to fill kare

or fir e-way no fill kare.

e-way bill no : fill kare.

then Entry complete ho gayi he apke e-way bill ki.

e-way bill ki Reports dekhana

iske liye apko

step 1:- Display/StatutOry Report/GST/e-Way Bill/

me Enter karna hoga.

step 2:- e-way bill Reports

option me enter kare.

apko details show ho jayegi.

ap facebook page "tallyseekhe" ke madyam se bhi humse jud sakte he.

Wonderful blog. Thanks for sharing informative Post. Its very useful to me.

जवाब देंहटाएंTally ERP Training in Ameerpet, Hyderabad

thanks for sharing these blogs, I learn many thing about tally

जवाब देंहटाएंWelcome

हटाएंTula's International School is the best Dehradun boarding schools for girls & boys. It is one of the top schools in Dehradun.

जवाब देंहटाएंThe school is affiliated to CBSE which offers holistic education to students.

Tula's International School Best Boarding School in Dehradun

Tula's International School Best Boarding School in Dehradun

Tula's International School Co-ed Boarding School in Dehradun

Tula's International School Best Residential School in Dehradun

Tula's International School Dehradun Boarding School Fee structure

Tula's International School Top Girls Boarding School India

Tula's International School Best CBSE Schools in Uttarakhand

Tula's International School Top Boarding Schools in India

Tula's International School MCA College in Dehradun

Tula's Institute Best Private BJMC College in Dehradun

Tula's International School is the best Dehradun boarding schools for girls & boys. It is one of the top schools in Dehradun.

जवाब देंहटाएंThe school is affiliated to CBSE which offers holistic education to students.

Tula's International School Best Boarding School in Dehradun

Tula's International School Best Boarding School in Dehradun

Tula's International School Co-ed Boarding School in Dehradun

Tula's International School Best Residential School in Dehradun

Tula's International School Dehradun Boarding School Fee structure

Tula's International School Top Girls Boarding School India

Tula's International School Best CBSE Schools in Uttarakhand

Tula's International School Top Boarding Schools in India

Tula's International School MCA College in Dehradun

Tula's Institute Best Private BJMC College in Dehradun

Thanks for the clarity and detail!

जवाब देंहटाएंTop Playway School In Chandigarh

Best Playway School In Chandigarh

Playway School Near Me

Thanks for the clarity and detail!

जवाब देंहटाएंTop Playway School In Chandigarh

Best Playway School In Chandigarh

Playway School Near Me