GST me apne

ager apne Basic GST seekh liya he to ap GST ki Entrie tally me karna

bhi seekh sakte he lekin dosto jab hum tally me GST ki Entries karenge

to GST ka Data fill karna hoga jisme kuch keyword ayenge jinki jankari

honi jaruri he To jante he is post me

GST Learning keyward.

GSTIN:-Goods

& Service Identification Number dosto Jub dealer GST portal me

Registration karata he to use ek GST portal Account drawa ek

Identification No provide kiya jata he jise hum GSTIN kahte he. Is no ke

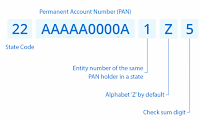

dwara government ko dealer ke Tax ki puri jankari milti he.Fortmat of GSTIN

Format of GSTIN

State or State Code in GSTIN:- dosto GSTIN me pahle 2 digit State ka code hota he. har state ka alag alag code hota he ap google ke madhyam se GST State find kar sakte he.

- इन्हें भी जाने :-

- SGST , CGST, IGST, kya he GST me

- GST in Tally online course Hindi me.

Applicable From:- wo date jab se GST apply hua he Like as 1-07-2017.

Registration type:- Dealar ka prakar

1.Regular:-jisne GST portal me Registration kiya he.

2.Unregistered:- Jisne GST portal me Registration nahi kiya he.

3.Composition:- Jisne Composition Shame ke tahet GST portal me registration kiya he.

4.Consumer:-Ager ak kewal ek costumer me he.

5.Unknown:- Dealer ka GST ke bare me kuch jankari nahi he.

Party type:-jisko goods sale ya Jisse goods purchase kar rahe ho wo company ka type kya he.

1.Not Applicable:-avilable types me se dealar ka type koi nahi he.

2.Deemed Export:-

3.Embassy/UN Body:-

4.Goverment Entity:-

5.SEZ:-

e-commerce Operator:-Ager aap Online payment karte he Tax ka.

Type of Supply :- aap goods sale purchase kar rahe he ya Services provide or Recieved.

1.Taxability:-Goods GST me GST rate ke ausar kiss type ka he.

2.Unkown:-kuch nahi pata he

3.Exempt:- we goods jo GST me samil kiya gaya he likin ITC ke under claim me nahi ate inme GST rate 0% ho sakta he. Like Bread, fresh fruits, fresh milk and curd etc.

4.Nill rated:- we goods Jo GST me Samil he lekin jin me GST rate 0% he. Like salt, Grains, jaggery, electricity etc.

5.Taxable:-GST me samil we goods jinme GST rate 5% ya 12% ya 18% ya 28% lagu hota he.

None GST goods:- we goods & services jin me GST lagu nahi hota he. lekin we anya Tax ke under ho sakte he. Petrol, alcohol etc.

Integrated Tax :- Ager Goods Taxable he to GST ki dar kya he goods me 5% ya 12% ya 18% ya fir 28%.

HSN Code:-Harmonized System Nomenclature code ye goods ka GST code hota he jo 2 se lekar 8 Digits ka ho sakta he. Ye code product ko Identify karta he sathi is code ke dwara product me GST ka Rate all India me ek sa rahta he. dosto aap kisi prodect ka HSN code google search ke madhyam se dekh sakte he.

Example:-

| Chapter | Description | HSN Code | Rate (%) | Effective From | CESS (% | Related Export/Import HSN Codes |

|---|---|---|---|---|---|---|

| Eggs, Honey & Milk Products (2) | Butter and other fats (i.e. ghee, butter oil, etc.) and oils derived from milk; dairy spreads | 0405 | 12 | 28/06/2017 | 04051000, 04052000, 04059010, 04059020, 04059090 | |

| Curd; Lassi; Butter milk | 0403 | NIL | 28/06/2017 | 04031000, 04039010, 04039090 |

SAC:-Service Accounting Code ye Services ka GST code hota he.

Example:-

| SAC Code | Description of Services | Rate (%) | Effective From | Also Check |

|---|

| 995472 | Plastering services | 18 | 28/06/2017 | also check SAC Code 99 or 9954 |

| 995473 | Painting services | 18 | 28/06/2017 | also check SAC Code 99 or 9954 |

Dosto Ager Apne GST or GST re Related keywords ko samajh liya he to ab aap tally me GST ki Easly Entries karna seekh sakte he.

dosto agear aap GST Kewords se releled kuch or puchhana chhahte he to comment ke madhyam se puch sakte he.

ap facebook page ke madyam se bhi humse jud sakte he.

Tally Erp 9 self learning lessons,GST and coustomised TDL modules free, others charged its for 1000 to 15000 price range…. subscribe my YouTube channel..

जवाब देंहटाएंhttp://www.youtube.com/c/ShajanKJ

Thank you for share you tallent

जवाब देंहटाएंbest telly erp 9 course

A full-service accounting firm is a particular kind of accounting firm that can assist with all facets of financial and tax services and provides a wide range of services to people and corporations.

जवाब देंहटाएंbookkeeping and tax services

full service accounting firm