dosto agar humne tally me GST ki basic Jankari ko seekh liya he to hum is post ke madhyam se GST ko Tally me Set karna or GST ke Ledger banana jan sakte he. to dosto hum sabse pahle GST ki details company me Set karna jante he.

Step 1:-then press F11 Company Feature

Step 2:-then press S Statutory & Taxation

Step3:-Enable Goods and Services Tax (GST) Yes type kare

Step 4:-set/alter GST details Yes type karte he.

Step 5:- State : apne company ka State select karte he GST ke liye.

Step 6:- GSTIN/UIN: apne company ka Sahi 15 digit no fill karte he.

Step 7:- Applicable from : GST jab se lagu hua he uss date ko fill karte he Like us 1-7-2017.

Step 8:- Enable tax Liability on advance reciepts ? no

Step 9:- Enable tax Liablitiy on reverse charge ? no

Step 10:- Set /Alter Gst details : is option me Yes hum us condition me karte he jab hamari company kewal 1 prodect ka business karti he other wise no type karte he.

Example: jaise hamari company kewal Butter ka Business karti he to puri comany ke liye Butter ki GST details is option se fill kar sakte he jaise HSN code, GST rate , Taxability etc.

Step 11:-Enable goods Classification no

Step 12:-provide LUT/Bond Details no

then Enter Enter Accept.

dosto iske bad hame GST ki Ledger banane hote he.

2-CGST

2-IGST

GST-Goods & Services Tax ke liye.

OTHER- other tax jinki jankar tally me nahi he.

VAT-Value Add tax ke kiye.

T.D.S-tax detection at source ke liye.

2-Central Tax for CGST ke liye.

3-Integrated Tax for IGST ke liye.

4- Cess: GST me other Tax ke liye

>Ledger

>Create

Step 2:-Fill Legder name SGST

Under: Duties & tax

Type of Duties/tax : GST

Tax type: State Tax

Percentage of calculation: sabhi Prodect me ek sa GST ke Rate ek sa to fill karte he Other wise blank

rounding method:not Applicable

then

Enter Enter Accept.

Isi prakar CGST or IGST ka Leger banate he.

Sale Purchase Ledger in GST : GST ki details ko Sale Purchase ke legder me bhi Applicable kanana hota he.

Note:- GST Rate ko Sale or Purchase Ledger me tabhi Fill karte he jab hamari company ek hi prodect ko sale or purchase kar rahi he.

Set GST Rate in Item (Goods), Prodect.

Prodect ki ko Inventry Info me ja kar hum unme Prodect ko GST rate, HSN code fill karte he.

dosto Is prakar hum apne new or old Company me GST ka Setup kar sakt he. dosto agar hamri companies old he or hamare Dealer ne GST portal me Registration kara liya he. to hame apne sabhi dealer ke GST details ok udate kana hoga sath hi prodect me GST Details ko bhi update karna hoga.

1- ITem GST rate update

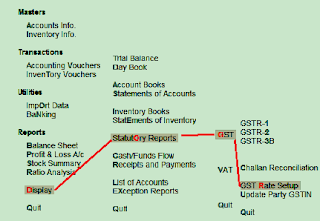

Step 1:- Press D or Enter Display.

Step 2:-Press O or Enter Statutory Report

Step 3:-Press G or Enter GST

Step 4:-Press R or Enter Rate Setup

Step 5:-select Groups Ceditor or Debtor

Step 6:-select Item for update GST

Step 7:-Set date, HSN/SCA, IGST, SGST, CGST & Cess

2-Update Party GSTIN in tally

Step 1:- Press D or Enter Display.

Step 2:-Press O or Enter Statutory Report

Step 3:-Press G or Enter GST

Step 4:-Press U or Enter Update Praty GSTIN

Step 5:-select Groups Ceditor or Debtor

Step 6:-select Credotitor or Debtor Ledger for Set GST details

Step 7:-Set Registration type:-

Step 8:-e commerse operator :Yes or No for online payment.

Step 9:-GSTIN:- Fill dealer GSTIN.

dosto Agli Post me hum tally me GST wali transection ki Voucher Entries karna janegae

dosto agear aap GST se releled kuch or puchhana chhahte he to comment ke madhyam se puch sakte he.

ap facebook page ke madyam se bhi humse jud sakte he.

- इन्हें भी जाने :-

- SGST , CGST, IGST, kya he GST me

- GST in Tally online course Hindi me.

GST tally me Set karna.

sablse pahle hume Tally erp 9 ka latest version Release 6.1.2 download karna hogo kyo ki Tally me Erp 9 ke bad Release Version me GST support karte he pahle ke Version me GST ka Setup nahi hota he.- इन्हें भी जाने :-

- Tally Letest Version GST download kare.

tally me GST Tax option on karna.

tally softwere ko Install karne ke baad tally me hum apni company select karte he.Step 1:-then press F11 Company Feature

Step 2:-then press S Statutory & Taxation

Step3:-Enable Goods and Services Tax (GST) Yes type kare

Step 4:-set/alter GST details Yes type karte he.

Step 5:- State : apne company ka State select karte he GST ke liye.

Step 6:- GSTIN/UIN: apne company ka Sahi 15 digit no fill karte he.

Step 7:- Applicable from : GST jab se lagu hua he uss date ko fill karte he Like us 1-7-2017.

Step 8:- Enable tax Liability on advance reciepts ? no

Step 9:- Enable tax Liablitiy on reverse charge ? no

Step 10:- Set /Alter Gst details : is option me Yes hum us condition me karte he jab hamari company kewal 1 prodect ka business karti he other wise no type karte he.

Example: jaise hamari company kewal Butter ka Business karti he to puri comany ke liye Butter ki GST details is option se fill kar sakte he jaise HSN code, GST rate , Taxability etc.

Step 11:-Enable goods Classification no

Step 12:-provide LUT/Bond Details no

then Enter Enter Accept.

dosto iske bad hame GST ki Ledger banane hote he.

Tally me GST ke 3 Ledger hote he.

1-SGST2-CGST

2-IGST

GST ke Ledger Under kiss grops ke banaye jate he.

dosto Tax company ke liye Liabilities ke Current Liablities hoti he. Current Liabilities me Tax ke liye ek Groups hota he Duties & Tax . GST or any tax ke ledger Duties & Tax Group ke Under bante he.Duties & Tax me kon kon se tax hote he.

CST-Central Sale Tax ke liye.GST-Goods & Services Tax ke liye.

OTHER- other tax jinki jankar tally me nahi he.

VAT-Value Add tax ke kiye.

T.D.S-tax detection at source ke liye.

Tally me GST me Tax type

1-State tax for SGST ke liye.2-Central Tax for CGST ke liye.

3-Integrated Tax for IGST ke liye.

4- Cess: GST me other Tax ke liye

tally me GST ke ledger banana.

Step 1:->Account info>Ledger

>Create

Step 2:-Fill Legder name SGST

Under: Duties & tax

Type of Duties/tax : GST

Tax type: State Tax

Percentage of calculation: sabhi Prodect me ek sa GST ke Rate ek sa to fill karte he Other wise blank

rounding method:not Applicable

then

Enter Enter Accept.

Isi prakar CGST or IGST ka Leger banate he.

Dealer ka Ledger banana

Dealer ko ki hamare liye Creditor or Debtor ho sakta he. ka Legder banana ke liye Dealer ki Complete details GSTIN, State , Address fill kana hota he.Sale Purchase Ledger in GST : GST ki details ko Sale Purchase ke legder me bhi Applicable kanana hota he.

Note:- GST Rate ko Sale or Purchase Ledger me tabhi Fill karte he jab hamari company ek hi prodect ko sale or purchase kar rahi he.

Set GST Rate in Item (Goods), Prodect.

Prodect ki ko Inventry Info me ja kar hum unme Prodect ko GST rate, HSN code fill karte he.

dosto Is prakar hum apne new or old Company me GST ka Setup kar sakt he. dosto agar hamri companies old he or hamare Dealer ne GST portal me Registration kara liya he. to hame apne sabhi dealer ke GST details ok udate kana hoga sath hi prodect me GST Details ko bhi update karna hoga.

GST Rate update in Tally

1- ITem GST rate update

Step 1:- Press D or Enter Display.

Step 2:-Press O or Enter Statutory Report

Step 3:-Press G or Enter GST

Step 4:-Press R or Enter Rate Setup

Step 5:-select Groups Ceditor or Debtor

Step 6:-select Item for update GST

Step 7:-Set date, HSN/SCA, IGST, SGST, CGST & Cess

2-Update Party GSTIN in tally

Step 1:- Press D or Enter Display.

Step 2:-Press O or Enter Statutory Report

Step 3:-Press G or Enter GST

Step 4:-Press U or Enter Update Praty GSTIN

Step 5:-select Groups Ceditor or Debtor

Step 6:-select Credotitor or Debtor Ledger for Set GST details

Step 7:-Set Registration type:-

Step 8:-e commerse operator :Yes or No for online payment.

Step 9:-GSTIN:- Fill dealer GSTIN.

dosto Agli Post me hum tally me GST wali transection ki Voucher Entries karna janegae

dosto agear aap GST se releled kuch or puchhana chhahte he to comment ke madhyam se puch sakte he.

ap facebook page ke madyam se bhi humse jud sakte he.

good h sir g

जवाब देंहटाएंuseful information, thanks for the sharing.

जवाब देंहटाएंgst accounting

thanks

हटाएंexcellent description

जवाब देंहटाएंthanks

हटाएंi have found such a useful information in this blog thanks for sharing it. If you are a new company or want a GST registration in INDIA connect with Swarit Advisors.

जवाब देंहटाएंOk Swarit

हटाएंok thanks

जवाब देंहटाएंWelcom

हटाएंThanks sir

जवाब देंहटाएंYou are very good sir

Wlcm

हटाएंThanks👍

Bery nice✌️👌

जवाब देंहटाएं