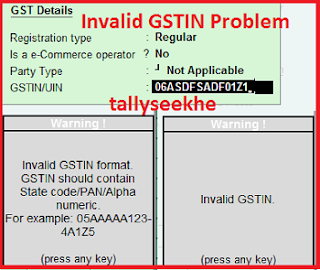

dosto kai bar tally me GSTIN number ko fill karne tally dwara invild GSTIN no show kiya jata he Kyo ki GSTIN code ka ek formate hota he iske dwara dealer ki valid information tally or GST portal ko mil jati he. agar GSTIN code ko hum Galat format me fill karte he to tally "Invalid GSTIN format GSTIN should contain State code/Pan/Alpha Numerical. For

Example:"05-AAAAA123-4A1Z5" show karta he. Is massage ka matlab hota he ki apne GSTIN code ka Joformate hota he Us format me GSTIN code fill nahi kiya he.

Invalid GSTIN Problem.

dosto Agar apne GSTIN code ko Sahi formate me fill kiya he to fir agar tally apko "Invalid GSTIN" massage show karta he."Iska matalab he aap ne GST portal me registration nahi kiya he ya jis dealer ka ye code he usne GST portal me registration nahi kiya he ya fir Us Dealer ne Registration kiya he lekin tally me humne jab GSTIN code fill kiya Uska format to sahi likin code ka koi digit(Letter) galaf type hua he. Dosto tally GSTR ki details apko tabhi sahi show karega jab apne tally me GSTIN no sabhi ke sahi fill kiye honge agar apne GSTIN wrong fill kar diye he to Tally GST report Create nahi kar payega.GST Learning me Registered GSTIN karna fill kya Jaruri he?

dosto tally me Dealer ke Ledger me GST ki details hame sahi fill karni hoti he yani ager hum tally ko education mode me use kar rahe or GST wali transection kar rahe he to hume pahle Computer me Tally me GST wale version me tally release 6.0.1 se palhe ke Version Install karna hogoa isme GSTIN code (jo GST portal me registered nahi he ya hamare dwara banaya gaya code he) wo fill karne per "Invalid GSTIN" show hoga lekin GST ki report sahi show ki jayegi" lekin agar hum tally me letest tally release 6.0.1 se above ke Version Install karke Education mode me GST ki details fill karte or hum GST code GSTIN formate me fill karte he lekin ye code kisi company ka nahi he to tally me Invalid GSIN show hoga or tally GST ki report sahi show nahi karega.

esa isliya hota kyo ki GST portal jis tarike se GSTIN code generate karta he. tally release ke Letest version me bhi GSTIN code ko check karne ke liye usi tarika ha use kiya gaya or jaise jaise Indian Goverment dwara GST me sudhar kiya ja raha he tally me bhi GST ko lekar or Feature ko badaya ja raha he or tally dwara fir naye feature ke sath tally ka letest version launch kiya ja raha h.e

- इन्हें भी जाने :-

- tally online course kya he.

- GST complete course in Hindi

Fortmat of GSTIN

Format of GSTIN

GSTIN No.:-15

digits ka hota he. Jis me pahle 2 digits Dealer ke State ho show karte

he i.e. Dealar kis rajya ka he. uske bad ke 10 digit Dealer ka PAN

Number hota he. PAN Number ke bad 1 digit Us dealer dwara ek PAN se bani

Us State me Total companies ko show karta he. Uske baad A toZ alphabet

me se ke alphabet hota he then Last me Ek digit hota he jo sabi Number

Digits ka Sum Erore check karne ka hota he.

State or State Code in GSTIN:- dosto

GSTIN me pahle 2 digit State ka code hota he. har state ka alag alag

code hota he ap google ke madhyam se GST State find kar sakte he.

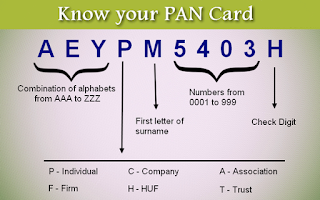

PAN (Permanent Account Number):-state code ke bad GSTIN me Pan hota he. Joki 10 digits ka hota he. in 10 digits ko 5 bhago me divided kiya jata he.

- इन्हें भी जाने :-

- tally me GST details fill karna.

- GST ke Ledger kaise banay tally me

A=Association

C=CompanyF=Firm

H=HUF

P=Individual

T=Trust

5th alphabetic Letter apke surname ka 1st Letter hota he. uske bad 4 digits ka code hota he. jo ki 0001 se lekar 9999 ke bich ka hota he. then last 10th Letter jo alphabetic hota he. wo A to Z me se hota he. jo Check digits ka hota he.

dosto agear aap GSTIN se releled kuch or puchhana chhahte he to comment ke madhyam se puch sakte he.

ap facebook page ke madyam se bhi humse jud sakte he.

It's a Awesome and very beneficial Blog

जवाब देंहटाएंThanks for sharing

Visit @ Accounting courses in chandigarh