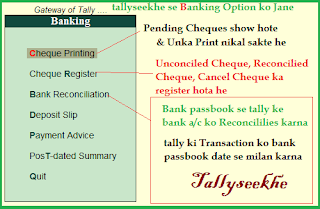

dosto isse pahle humne tally me Cheque Print karna seekha. is post me hum Bank se Related Option Cheque Printing, Cheque Register, Bank Reconciliation, Deposit Slip, Payment Advice, Post dated Sammery ke bare seekhenge.

Getway of tally ke Utilities Category me hume Banking ka option show hota he. is option ki madad se hum apni bank ki pass book or cheque books to tally me Maintain karte he.

Tally me Banking option me hume Some following option Show hote he.

BaNking

Cheque Register:-Ye Option Cheque book ka Register hota he. Is Register me Hame sabhi cheque books ke payment ke liye banaye gaye cheque show hote he. Jo Unreconciled(bank pass book se milan nahi kiya gaya he) hote he. jinhe hume is option ke dwara Bank pass book date se milan karke Bank date fill karke Reconcile karte he. jiske liye ham F5 press karte he.

dosto is hum example dawara samejte he.

hamne abhi tak Cheque dwara payament ki 3 Entries tally me ki he. or bank pass book me Entry karne par hame pata chala ki

abhi tak 1.4.2018 ko Creditor ko chueqe 00001, 00002, and 00003(date:-02.04.18) ke dwara payement kiya he

jise Creditor ne Apne Bank A/c me Cheque no. 00001, ko 1.4.18 and Cheque no. 00002 and 00003 ko 02.04.18 ko apne a/c me diposit kiya he.

jinhe hame ab 01.04.18 and 02.04.18 ki date me Reconcile karna he.

iske liye hame

Banking >Cheque Register> Select Bank >press F5

Cheque Register me F5 press karke Reconcile karna hoga

or bank passbook ki Entry date fill karke Accept karte he.

then ab hamare 3 cheque Reconcile ho gaye he.

Bank Reconciliation:-Bank Reconciliation ka matlab apne tally ke Bank Account ko apne bank ke passbook or Statement ke milaan karna hota he. ek tarah se ye hamari pass book hoti he. jisme hamare dwara tally me bank releted ki gayi sabhi Entries hoti he. jinka hamne apne bank ke passbook se Milan karna hota he.

dosto kai bar hame tally me bank Transaction ki Entry Current date me karte he. lekin bank me kisi karanwas wo transaction bad ke date me complete hoti. ese me tally me us transection ki date agal or bank passbook me agal hoti he. to ham tally me Bank Reconciliation option ke dwara bank passbook se us transaction ko Reconciles kar kar sakte he.

Bank Reconciliation tally me kaise kare.

Go to

BaNking > Bank Reconciliation

Select Bank Ledger

then open Bank ledger for Reconciliation

Reconciliation ko hum Bank Ledger me Enter karke bhi kar sakte he.

iske liye hame Bank Ledger me jana hota he fir F5 buttion press karna hota he.

dosto is hume Example ke dwara samajte he. hamne bank ki kuch transection 1.4.18 ko complete kari lekin bank passbook me in transection ki Entries 2.4.18 ko show ho rahi he or hume ab tally me bank ki 1.4.18 wali transection ko bank passbook se reconciles(milan) karna he. iske liye hume bank ledger me jakar f5 press karke

To Be Continue....................

ap facebook page "tallyseekhe" ke madyam se bhi humse jud sakte he.

Getway of tally ke Utilities Category me hume Banking ka option show hota he. is option ki madad se hum apni bank ki pass book or cheque books to tally me Maintain karte he.

Tally me Banking option me hume Some following option Show hote he.

BaNking

- Cheque Printing

- Cheque Register

- Bank Reconciliation

- Deposit Slip

- Payment Advice

- PosT-dated Summery

Cheque Printing:-Ye Option hume Print Cheque or Pending cheque ka Status batata he. yani Is option ke dwara hame Total Company dwara tally ke madyam se cheque dwara payment me print nahi huye cheque or print ho chuke cheque show hote he. jinme hum kuch sudhar karke unka print

nikal sakte he. sath is F6 press karke printed Cheque bhi Show or Edit

kar sakte.

cheque print ki pahle post me hamne kewal 2 chueqe 00001 or 00002 ka printout nikal ke payment ki Entry complete ki thi

is option ko samajne ke liye hume ek Cheque ke dwara payment ki entry kar hogi.

for Example:- hamne kisi Creditor ko 1.4.18 ko 5000 ka payment Chuque no. 000003 karna he is transection ki Entry tally me karne par hamne cheque print nahi kiya. Agle din hame Creditor ko cheque print karke 2.4.18 ke date me Cheque dena he. iske liye hame

tally me

cheque print ki pahle post me hamne kewal 2 chueqe 00001 or 00002 ka printout nikal ke payment ki Entry complete ki thi

is option ko samajne ke liye hume ek Cheque ke dwara payment ki entry kar hogi.

for Example:- hamne kisi Creditor ko 1.4.18 ko 5000 ka payment Chuque no. 000003 karna he is transection ki Entry tally me karne par hamne cheque print nahi kiya. Agle din hame Creditor ko cheque print karke 2.4.18 ke date me Cheque dena he. iske liye hame

tally me

Banking ke Cheque Printing me enter karna hoga:

to hame panding Cheque me 000003 show hoga jiska printout nahi nikla he ab hum is option me F7 (edit Cheque details) Press karke Instrument no. to thik he Instrument date ko Edit karke 02.04.2018 me print out nikalne ke liye Accept kar dete he or fir

is Entry ke Enter Enter karke Last me Print out nikal lete he.

ab hamare bank me panding cheques koi nahi he. sabhi printed cheque ko dekhane ke liye F6 press karte he.

Cheque Printing ka all shortcuts

to hame panding Cheque me 000003 show hoga jiska printout nahi nikla he ab hum is option me F7 (edit Cheque details) Press karke Instrument no. to thik he Instrument date ko Edit karke 02.04.2018 me print out nikalne ke liye Accept kar dete he or fir

is Entry ke Enter Enter karke Last me Print out nikal lete he.

ab hamare bank me panding cheques koi nahi he. sabhi printed cheque ko dekhane ke liye F6 press karte he.

Cheque Printing ka all shortcuts

F2:date:-(jis din ke Cheque ka status dekhana he wo date fill kare)

F4:Bank:-(jis Bank ke Cheque ko dekhana he wo select kare)

F6:Show All( sabhi Cheque ka Status dekhe)

F7:Edit Cheque Details( Cheque ka number or date edit kare

- इन्हें भी जाने :-

- E way bill kya he

- E way bill kaise Generate kare

dosto is hum example dawara samejte he.

hamne abhi tak Cheque dwara payament ki 3 Entries tally me ki he. or bank pass book me Entry karne par hame pata chala ki

abhi tak 1.4.2018 ko Creditor ko chueqe 00001, 00002, and 00003(date:-02.04.18) ke dwara payement kiya he

jise Creditor ne Apne Bank A/c me Cheque no. 00001, ko 1.4.18 and Cheque no. 00002 and 00003 ko 02.04.18 ko apne a/c me diposit kiya he.

jinhe hame ab 01.04.18 and 02.04.18 ki date me Reconcile karna he.

iske liye hame

Banking >Cheque Register> Select Bank >press F5

or bank passbook ki Entry date fill karke Accept karte he.

then ab hamare 3 cheque Reconcile ho gaye he.

dosto Ager hum kisi cheque de dwara party ko payment karte he bad me kisi karan se wo Entry hame Daybook ke jakar cancel karni padti he to wo cheque hame Canceled Category me show hote he. or Out of

Period category me Unreconciles kiye huye jinki date over ho jati he wo cheque show hote he.Bank Reconciliation:-Bank Reconciliation ka matlab apne tally ke Bank Account ko apne bank ke passbook or Statement ke milaan karna hota he. ek tarah se ye hamari pass book hoti he. jisme hamare dwara tally me bank releted ki gayi sabhi Entries hoti he. jinka hamne apne bank ke passbook se Milan karna hota he.

dosto kai bar hame tally me bank Transaction ki Entry Current date me karte he. lekin bank me kisi karanwas wo transaction bad ke date me complete hoti. ese me tally me us transection ki date agal or bank passbook me agal hoti he. to ham tally me Bank Reconciliation option ke dwara bank passbook se us transaction ko Reconciles kar kar sakte he.

Bank Reconciliation tally me kaise kare.

Go to

BaNking > Bank Reconciliation

Select Bank Ledger

then open Bank ledger for Reconciliation

Reconciliation ko hum Bank Ledger me Enter karke bhi kar sakte he.

iske liye hame Bank Ledger me jana hota he fir F5 buttion press karna hota he.

dosto is hume Example ke dwara samajte he. hamne bank ki kuch transection 1.4.18 ko complete kari lekin bank passbook me in transection ki Entries 2.4.18 ko show ho rahi he or hume ab tally me bank ki 1.4.18 wali transection ko bank passbook se reconciles(milan) karna he. iske liye hume bank ledger me jakar f5 press karke

bank date column me Date ko 2.4.18 kar karke Enter Enter press karke Accept kar lete he.

is prakar dosto ham tally me apne bank ke ledger ka apne bank ke passbook or bank statement se milan karke apne bank a/c ko tally me properly maintain kar sakte he.To Be Continue....................

ap facebook page "tallyseekhe" ke madyam se bhi humse jud sakte he.

I like this blog

जवाब देंहटाएंLots of thanks e banking

हटाएंReally nice information you had provided here. And i wanna appreciate within this. Thank you for providing this information and please keep update like this.

जवाब देंहटाएंOracle Training | Online Course | Certification in chennai | Oracle Training | Online Course | Certification in bangalore | Oracle Training | Online Course | Certification in hyderabad | Oracle Training | Online Course | Certification in pune | Oracle Training | Online Course | Certification in coimbatore

wow exellent work sir. you are doing a good job.... im thankful to you . keep uplaoding new post

जवाब देंहटाएंok

हटाएं

जवाब देंहटाएंgreat article thanks for sharing oracle training in chennai

An amazing offer! I have quite recently sent this onto a collaborator who had been directing a little schoolwork on this. What's more, he indeed got me supper because of the way that I discovered it for him... haha. So permit me to rephrase this.... Much obliged to YOU for the dinner!! Be that as it may, definitely, thanx for investing energy to talk about this point here on your site.

जवाब देंहटाएंlive

Thanks for the Information.

जवाब देंहटाएंPI India is an automotive magazine in india

Really appreciate you sharing these great insights!

जवाब देंहटाएंRheumatoid arthritis

thank you for this post, this post is very informative for me . I understand all the things that i need.

जवाब देंहटाएं