dosto hamne Abhi Tak GST Course me GST Ki Entries tally me karna seekha. Jisme humne GST Applicable wale protect ki Entries tally me ki. ab dosto is post me hum GST ki payment or GST payment ki calulation jante he.

dosto ager app new Viewer he to hum apke liye GST wali Transaction ko Is post me type kar dete he taki samajne me asani ho.

1-Business Started with Cash 100000

2- Purchase goods from Nainital Dealer 20000 With GST 12%

3-Purchase goods from Delhi Dealer 20000 With GST 12%.

4- Sold goods to Nainital Dealer 30000. with GST 12%

5- Cash reviced from Nainital Dealer 1000.

6-Paid to cash 5000 to Haridwar dealer.

7-paid cash to 1000 delhi dealer.

dosto is In transaction ki Entrie hamne tally me pahle ke post ke ki he. agar aap new Viewer he to inki Entries wali post Read karne ke liye click kare tally me GST Entries karna

Tax Calculation ke liye hume tally me

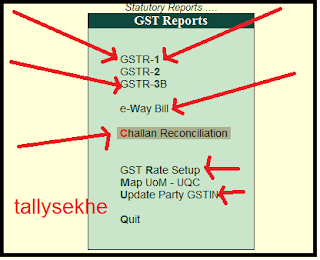

Display>StatutOry Reports> GST me Enter karna hota he.

GSTR-1= me hame Company Dwara kiye gaye Export (Outward Supply) ke GST detail dekhayi deti he.

B2B Invoice=Registered Dealer ko Sale ki details dikhayi degi.

B2B Invoice me

Taxbale Value=30000

Tax=(CGST=1800+SGST=1800)=3600

Invoice Amount=33600

GSTR-2= me hame Company Dwara Import (Inward Supply) ke GST details dekhayi deti he.

B2B Invoice=Registered Dealer se Purchase ki details dikhayi degi.

B2B Invoice me

Haridwar Dealer

1-Taxbale Value=20000

Tax=(CGST=1200+SGST=1200)=2400

ITC Availed =2400

Delhi Dealer

2-Taxbale Value=20000

Tax=(IGST=2400)=2400

ITC Availed =2400

Total

Taxbale Value=40000

Tax=(CGST=1200+SGST=1200+IGST=2400)=4800

ITC Availed =4800

dosto ab hame apne Tally dwara Generate GSTR form GSTR-1 or GST-2 form GST Portal me submit karne he. ya apna GST return barana he.

is bhar lene ke bad

GST portal hame batayega ki hame kitna GST ka payement karna he. or Kitana ITC (input Tax Credit) hame milega.

GST payment Amount=Sale GST Amount- Purchase GST Amount

=3600-2400

=1200

SGST=600

CGST=600

ka payment Goverment ko karna he.

iske liye hame

Accouting Voucher>Payment Voucher(F5)

Enter karte he.

then

hume Tax ka payment karna he. iske liye hame Statutory Voucher (Stat voucher) ka Use karte he.

press Alt+S(for Activate Stat voucher)

the fill

Tax type=GST

Period =1-4-2018 to 1-5-2018(fill hal is kewal Learning ke liye)

paymet type:-Regular

Dr SCGT 600

Dr CGST 600

Cr Cash 1200

Provide GST details=yes

Bank Details

Payment of Method=Cash over the Counter

Name of Bank= SBI Pithoragarh.

Common Portal Identification Number(CPIN)=123456

Callan Identification Number(CIN)=1245478

BRN/UTR=123369

Payment Date:-2-5-2018

Narration:- Paid GST

dosto agar humne is GST payment ki details tally me dekhani he to hume (Statutory Reports)GST me Challan Reconciliation me Enter karna hogo

then date fill 2-5-2018

if don't Show details

Press F12

Show Transaction having Challan detials= Yes

Show Narration= Yes or No

then apko apke Challan Reconciliation Show ho jayegi.

dosto ye post me kewal Registered Dealer Purchase or Registered Dealer Sale wali Transection ki GST payment ke bare me he.

1-Business Started with Cash 100000

2- Purchase goods from Nainital Dealer 20000 With GST 12%

3-Purchase goods from Delhi Dealer 20000 With GST 12%.

4- Sold goods to Nainital Dealer 30000. with GST 12%

5- Cash reviced from Nainital Dealer 1000.

6-Paid to cash 5000 to Haridwar dealer.

7-paid cash to 1000 delhi dealer.

dosto is In transaction ki Entrie hamne tally me pahle ke post ke ki he. agar aap new Viewer he to inki Entries wali post Read karne ke liye click kare tally me GST Entries karna

- इन्हें भी जाने :-

- SGST , CGST, IGST, kya he GST me

- GST in Tally online course Hindi me.

Display>StatutOry Reports> GST me Enter karna hota he.

GSTR-1= me hame Company Dwara kiye gaye Export (Outward Supply) ke GST detail dekhayi deti he.

B2B Invoice=Registered Dealer ko Sale ki details dikhayi degi.

B2B Invoice me

Taxbale Value=30000

Tax=(CGST=1800+SGST=1800)=3600

Invoice Amount=33600

GSTR-2= me hame Company Dwara Import (Inward Supply) ke GST details dekhayi deti he.

B2B Invoice=Registered Dealer se Purchase ki details dikhayi degi.

B2B Invoice me

Haridwar Dealer

1-Taxbale Value=20000

Tax=(CGST=1200+SGST=1200)=2400

ITC Availed =2400

Delhi Dealer

2-Taxbale Value=20000

Tax=(IGST=2400)=2400

ITC Availed =2400

Total

Taxbale Value=40000

Tax=(CGST=1200+SGST=1200+IGST=2400)=4800

ITC Availed =4800

dosto ab hame apne Tally dwara Generate GSTR form GSTR-1 or GST-2 form GST Portal me submit karne he. ya apna GST return barana he.

is bhar lene ke bad

GST portal hame batayega ki hame kitna GST ka payement karna he. or Kitana ITC (input Tax Credit) hame milega.

GST payment Amount=Sale GST Amount- Purchase GST Amount

=3600-2400

=1200

SGST=600

CGST=600

ka payment Goverment ko karna he.

GST payemt ki Entry Tally me kaise kare.

dosto ab hame GST ki payment karni he.iske liye hame

Accouting Voucher>Payment Voucher(F5)

Enter karte he.

then

hume Tax ka payment karna he. iske liye hame Statutory Voucher (Stat voucher) ka Use karte he.

press Alt+S(for Activate Stat voucher)

the fill

Tax type=GST

Period =1-4-2018 to 1-5-2018(fill hal is kewal Learning ke liye)

paymet type:-Regular

Dr SCGT 600

Dr CGST 600

Cr Cash 1200

Provide GST details=yes

Bank Details

Payment of Method=Cash over the Counter

Name of Bank= SBI Pithoragarh.

Common Portal Identification Number(CPIN)=123456

Callan Identification Number(CIN)=1245478

BRN/UTR=123369

Payment Date:-2-5-2018

Narration:- Paid GST

dosto agar humne is GST payment ki details tally me dekhani he to hume (Statutory Reports)GST me Challan Reconciliation me Enter karna hogo

then date fill 2-5-2018

if don't Show details

Press F12

Show Transaction having Challan detials= Yes

Show Narration= Yes or No

then apko apke Challan Reconciliation Show ho jayegi.

dosto ye post me kewal Registered Dealer Purchase or Registered Dealer Sale wali Transection ki GST payment ke bare me he.

gst return fill krne ka process batiye

जवाब देंहटाएंprocess Return fill karne ke liye apko GST Return form fill karna hota he jisme apko mahine bar me kiye gaye Import or Export ki details fill karni hoti he.

हटाएं